Financial Reporting - commonly asked technical questions (Standards issued but not yet effective)

The following are some of the more commonly asked questions based on technical enquiries received on accounting issues. The views expressed herein are developed by staff of the Hong Kong Institute of Certified Public Accountants (HKICPA). These are informal staff views and do not represent the official views of the HKICPA Council, standard setting committees, HKICPA management or other staff members of the HKICPA. The HKICPA and its staff do not accept any responsibility or liability in respect of the views expressed and any consequences that may arise from any person acting or refraining from action as a result of any materials below. Members of the HKICPA and other users of these materials should read the original text of the HKFRS Accounting Standards, HKFRS for Private Entities Accounting Standard and Small and Medium-sized Entity Financial Reporting Framework and Financial Reporting Standard as found in the HKICPA Members’ Handbook for further reference and seek professional advice when considering the materials below. If you could not find your question, please kindly submit your enquiry to us (see link).

Question:

Entity A is a manufacturing company and is preparing its financial statements. How should Entity A present its analysis of operating expenses in the statement of profit or loss and other comprehensive income? Should it classify its expenses based on their function or their nature?

View:

Paragraph 99 of HKAS 1 Presentation of Financial Statements requires an entity to present an analysis of expenses recognised in profit or loss using a classification based on either their nature or their function within the entity, whichever provides information that is reliable and more relevant.

Paragraph 105 of HKAS 1 states that the choice between the function of expense method and the nature of expense method depends on historical and industry factors and the nature of the entity. Both methods provide an indication of those costs that might vary, directly or indirectly, with the level of sales or production of the entity. Because each method of presentation has merit for different types of entities, HKAS 1 requires management to select the presentation that is reliable and more relevant.

The analysis by function is sometimes referred to as the ‘cost of sales’ method, and is adopted by most of the manufacturing companies. Depending on the factors as stated in paragraph 105 of HKAS 1, Entity A, as a manufacturing company, may consider presenting its operating expenses based on their function.

Entity A should not generally show some expenses by nature and others by function as this may lead to understatement on some lines items. Entity A should consider the following requirements when selecting the presentation method and assessing whether to include additional line items:

- Presentation of additional line items in the statement of profit or loss and other comprehensive income is relevant to an understanding of the entity’s financial performance [HKAS 1.85].

- Presentation is neutral (free of bias) [Conceptual Framework for Financial Reporting paragraph 2.15].

- Additional disclosures of analysis by nature are made in the notes [HKAS 1.104]; and

- Such presentation is consistently applied and explained in the accounting policies [HKAS 8.13].

Fact pattern:

Entity A is a manufacturing company. In order to utilise its excess cash, Entity A purchases and redeems short-term investments frequently. These investments are recorded as financial assets at fair value through profit or loss in the statement of financial position. Total annual gross cash flows for purchase and redemption of these investments are HKD 10 million and HKD 12 million, respectively.

Question:

Should Entity A present its cash flows for the purchase and redemption of short-term investments on a gross or net basis in the statement of cash flows?

View:

Paragraph 21 of HKAS 7 Statement of Cash Flows requires an entity to report separately major classes of gross cash receipts and gross cash payments arising from investing and financing activities, except to the extent that cash flows described in paragraphs 22 and 24 of HKAS 7 are reported on a net basis.

Paragraph 22 of HKAS 7 provides an exception that cash flows arising from the following operating, investing or financing activities may be reported on a net basis:

(a) cash receipts and payments on behalf of customers when the cash flows reflect the activities of the customer rather than those of the entity; and

(b) cash receipts and payments for items in which the turnover is quick, the amounts are large, and the maturities are short.

One of the examples in paragraph 23A of HKAS 7 that referred to the situation in paragraph 22(b) is the purchase and sale of investments.

Applying to the above fact pattern, Entity A purchases and redeems short term investments frequently, and this could be an example of cash receipts and payments referred to in paragraphs 22(b) and 23A of HKAS 7 if the turnover of the investments is quick, the amounts involved are large, and the maturities of the investments are short. Entity A may present the related cash flows in net, but this is not required. This is an accounting policy choice as to whether to present the cash flows relating to the purchase and redemption of investments on a net or a gross basis. Entity A should apply its accounting policy consistently for similar transactions according to paragraph 13 of HKAS 8 Basis of Preparation of Financial Statements.

Question:

Paragraph 27A of HKAS 8 Basis of Preparation of Financial Statements requires an entity to disclose material accounting policy information. How should one determine whether accounting policy information is material?

View:

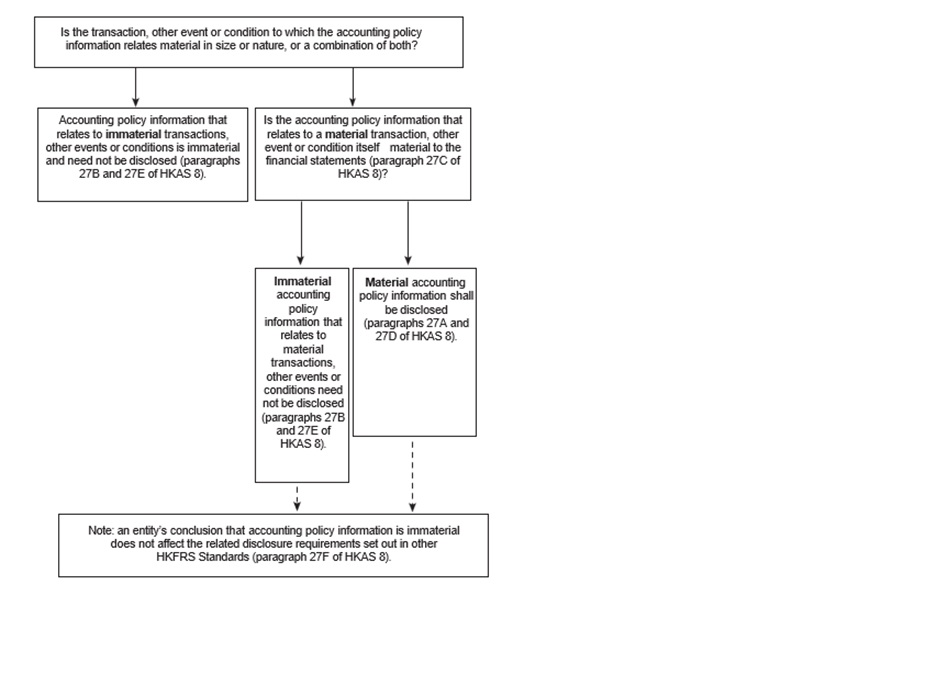

Paragraph 88C of HKFRS Practice Statement 2 Making Materiality Judgements explains that the materiality assessment for accounting policy information should follow the same guidance that applies to materiality assessments applicable to other information: by considering both qualitative and quantitative factors as described in paragraphs 44-55 of HKFRS Practice Statement 2. Diagram 2 of HKFRS Practice Statement 2 illustrates how an entity assesses whether accounting policy information is material and, therefore, shall be disclosed.

Paragraph 27C of HKAS 8 provides examples of circumstances in which an entity is likely to consider accounting policy information to be material to its financial statements. The list is not exhaustive, but provides guidance on when an entity would normally consider accounting policy information to be material. These examples are

- the entity changed its accounting policy during the reporting period;

- the entity chose the accounting policy from one or more options permitted by HKFRSs;

- the accounting policy was developed in accordance with HKAS 8 in the absence of an HKFRS that specifically applies;

- the accounting policy relates to an area for which an entity is required to make significant judgements or assumptions in applying an accounting policy; or

- the accounting required for the transaction is complex.

In addition, paragraph 27D of HKAS 8 highlights that it is more useful to users of financial statements that an entity provides entity-specific information than standardised information, or information that only duplicates or summarises the requirements of the HKFRS Accounting Standards. HKFRS Practice Statement 2 provides two examples that illustrate making materiality judgements and:

- providing entity-specific information, while avoiding standardised (boilerplate) accounting policy information (Example S); and

- providing accounting policy information that only duplicates requirements in HKFRS Standards (Example T).