非過渡性安排的常見問題

Questions and Answers on financial reporting issues relating to the new Companies Ordinance (Cap. 622) ("new CO")

(other than those relating to transition from the predecessor Ordinance (Cap. 32))

These Questions and Answers ("Q&As") have been developed by the Institute's Companies Ordinance Application Issues (Financial Reporting) Working Group (Working Group) and are endorsed by the Institute's Financial Reporting Standards Committee (FRSC). These Q&As will be updated from time to time to provide guidance on emerging financial reporting related application issues on the Hong Kong Companies Ordinance (Cap.622).

These Q&As have been developed by the Working Group to cover other financial reporting related application issues relating to requirements of the new Hong Kong Companies Ordinance (Cap.622) which are expected to have continuing relevance beyond the end of the first financial reporting year beginning on or after 3 March 2014. A separate series of Q&As has been developed by the Working Group to cover financial reporting related application issues specific to the transition from the predecessor Hong Kong Companies Ordinance (Cap. 32) to the new Hong Kong Companies Ordinance (Cap.622).

These Q&As are non-mandatory in nature and intended for general guidance only. Users of these Q&As should consider taking their own legal advice if in doubt as to their obligations under the Hong Kong Companies Ordinance.

The Institute, the FRSC and the Working Group do not accept responsibility or liability, and disclaim all responsibility and liability, in respect of the Q&As and any consequences that may arise from any person acting or refraining from action as a result of any materials in the Q&As.

All references to Parts, Divisions, Sub-divisions, Schedules and sections in the questions and answers are to the new CO, unless otherwise indicated.

Last revision date: 19 June 2015

| Q1. | Question A1 - Claiming exemption from preparation of a business review Question A1a: How can a company claim exemption from preparing a business review for the directors' report? [UPDATED] |

Answer

Section 388(3) sets out 3 situations under which a company is exempt from including a business review in the directors' report in compliance with Schedule 5. These are:

(a) the company falls within the reporting exemption;

(b) the company is a wholly owned subsidiary of another body corporate at the end of the financial year; or

(c) the company is a private company that does not fall within the reporting exemption for the financial year, and a special resolution is passed by members to the effect that the company is not to prepare a business review required by that Schedule for the financial year.

For the purposes of claiming exemption from preparing a business review, a company need only satisfy any one of the three exemption criteria set out in section 388(3). Therefore if a company satisfies either criterion (b) (i.e. it is a wholly owned subsidiary) or criterion (c) (it is a private company and its members have passed a special resolution), it is not necessary to consider whether the company would also have been able to claim exemption under criterion (a) (i.e. to consider whether it would also have fallen within the "reporting exemption").

NB: If the purpose is only to claim exemption from preparing a business review, in practice, given the complexity of the size tests and shareholder approval requirements for the reporting exemption, it will generally be more straightforward for a private company to ask its members to pass a special resolution in accordance with section 388(3)(c). There is no need to seek to test whether the company is eligible for the reporting exemption in accordance with sections 359 to 366A of, and Schedule 3 to, the new CO. However, if the purpose is also to claim the reporting exemption from the requirement for the financial statements to give a true and fair view then it will be necessary to comply with the requirements of sections 359 to 366A and Schedule 3.

Unlike criteria (c) of section 388(3), criterion (b) is not limited to just private companies. Accordingly, a public company (as defined in section 12) that is a wholly owned subsidiary of another body corporate can obtain the exemption from preparing a business review.

For the meaning of "wholly owned subsidiary of another body corporate" see Question E1 below.

| Q2. | Question A1 - Claiming exemption from preparation of a business review Question A1b - For the purposes of gaining an exemption from including a business review in the directors' report under section 388(3), are all private companies eligible? [UPDATED] |

Answer

A private company is defined in section 11 as a company which is not limited by guarantee and whose articles (i) restrict a member's right to transfer shares, (ii) limit the number of its members to 50 and (iii) prohibit any invitation to the public to subscribe for any shares or debentures of the company.

All private companies (including those in financial services lines of business listed in section 359(4)) are eligible to gain exemption from preparing a business review provided they satisfy either section 388(3)(b) (i.e. the company is a wholly owned subsidiary) or section 388(3)(c) (it is a private company and its members have passed a special resolution).

However, this entitlement may be lost if at any time during a financial year the company acts in a way contrary to the three key elements characterizing a private company listed above, for example, if the membership of the company in practice exceeds 50 members during the year. In such a case, the directors' report relating to that financial year is required to contain a business review, unless the company is also a wholly owned subsidiary of another body corporate at the end of the financial year. This provision is set out in section 389, which also includes further provisions relating to applications that may be made to the Court in this regard.

Private companies that do not satisfy either sub-sections (b) or (c) of section 388(3) may still be able to gain exemption under sub-section (a) (i.e. if the company satisfies the size criteria for small private companies or groups under the reporting exemption). However, in this regard, it should be noted that private companies in the financial services lines of business listed in section 359(4) are not eligible for the reporting exemption, even if they satisfy those small size criteria. These types of companies include, for example, corporations licensed under Part V of the Securities and Futures Ordinance to carry on a business in any regulated activity within the meaning of that Ordinance.

| Q3. | Question A1c: For the purposes of gaining an exemption from including a business review in the directors' report under section 388(3)(c), what is a "special resolution"? |

Section 564 sets out the meaning of a "special resolution" and contains details of the procedures to be followed in order to pass a special resolution. This section applies in the case of passing the special resolution to be obtained under section 388(3)(c), in addition to the specific requirements on this matter set out in section 388(4).

| Q4. | Question A1d: If the company is eligible for the reporting exemption under sections 359 to 366A of, and Schedule 3 to, the new CO but voluntarily chooses to prepare its financial statements using HKFRS Accounting Standards or HKFRS for Private Entities Accounting Standard instead of the SME-FRF & SME-FRS, can it still claim exemption from preparing a business review under section 388(3)(a)? [UPDATED] |

Answer

Yes it can still claim exemption from preparing a business review under section 388(3)(a). This exemption does not depend on whether the financial statements are prepared in accordance with the SME-FRF & SME-FRS. The important factor for the purposes of section 388(3)(a) is whether the company (or group) is eligible for the reporting exemption i.e. whether it is not in a financial services line of business listed in section 359(4), whether the company (or group) falls within the size tests and, in some cases, whether the necessary shareholder approvals have been obtained.

| Q5. | Question A1e: Can a company limited by guarantee with revenue of more than HK$25 million exempted from preparing a business review? [UPDATED] |

Answer

Section 388(3) sets out 3 situations under which a company is exempt from including a business review in the directors' report in compliance with Schedule 5. These are:

(a) the company falls within the reporting exemption;

(b) the company is a wholly owned subsidiary of another body corporate at the end of the financial year; or

(c) the company is a private company that does not fall within the reporting exemption for the financial year, and a special resolution is passed by members to the effect that the company is not to prepare a business review required by that Schedule for the financial year.

A company limited by guarantee with revenue of more than HK$25 million is not eligible to fall within the reporting exemption under section 359(1) as it exceeds the threshold of HK$25 million as specified in section 1(5) of Schedule 3. Such a company is therefore not exempt from preparing a business review under section 388(3)(a). Please see section 363 for the meaning of “small guarantee company” referred to in section 359(1).

Section 11 specifically excludes a company limited by guarantee from the definition of a private company. A company limited by guarantee therefore cannot be exempted from preparing a business review by way of passing a special resolution under section 388(3)(c).

It follows that a company limited by guarantee with annual revenue of more than HK$25 million can only be exempted from preparing a business review by being a wholly owned subsidiary of another body corporate and therefore being eligible to rely on section 388(3)(b). Under section 357(3) a company (including a company limited by guarantee) is a wholly owned subsidiary of another body corporate if it has only the following as members:

(a) that other body corporate;

(b) a wholly owned subsidiary of that other body corporate;

(c) a nominee of that other body corporate or such a wholly owned subsidiary.

Please refer to Question E1 and E2 for the meaning of "wholly owned subsidiary of another body corporate" and "body corporate".

| Q6. | Question A1f: Can a company claim exemption from preparing a business review for the directors' report by written resolution? |

Under section 388(3)(c) a private company that does not fall within the reporting exemption can claim exemption from preparing a business review for the directors' report for the financial year by special resolution.

Under section 548(3) a resolution may be passed as a written resolution, if a resolution is required to be passed as an ordinary resolution or a special resolution. Accordingly a company can claim the exemption from preparing a business review by written resolution, instead of special resolution. A written resolution can be passed without a meeting and without any previous notice being required.

However, a written resolution that is passed for the purposes of section 388(3)(c) must comply with section 388(4) which requires the resolution to be passed at least six months before the end of the financial year to which the directors' report relates.

Having said that, passing a written resolution requires all eligible members signify their agreement to it. This is a higher threshold than the special resolution, which needs to be passed by majority of at least 75%. Moreover, for passing a written resolution pursuant to the provisions in subdivision 2 of division 1 in Part 12 of the new CO the company needs to follow other procedures in the subdivision , which include notifying its auditor of the proposed resolution under section 555.

Same as for the special resolution (please refer to Question A5), the company under section 622(1)(b) and section 622(2) must deliver a copy of the written resolution to the Companies Registrar for registration within 15 days after it is made or passed.

Please refer to subdivision 2 of division 1 in Part 12 of the new CO for reference.

| Q7. | Question A1g: How should a company which is exempted from preparing consolidated financial statements under the new Companies Ordinance be assessed for the reporting exemption and hence is exempted from including a business review in the directors' report? |

Answer

Under section 388(3)(a) a company that falls within the reporting exemption is exempted from including a business review in the directors' report in compliance with Schedule 5 to the new CO.

Section 379(3) contains requirements on when companies are exempted by the new CO from preparing consolidated financial statements.

As highlighted in the response to Question D6, it would seem reasonable to assume that a correlation is intended between the requirements in section 379(3) and section 359 (on the eligibility to claim the reporting exemption).

Based on such assumption, for the purpose of section 388(3)(a), if the holding company is exempted from preparing consolidated financial statements under section 379(3), then it should be assessed for the reporting exemption as a stand-alone company under section 359(1) and if it qualifies it will be exempted from including a business review in the directors’ report.

Whereas, if the holding company is not exempted by the new CO from preparing consolidated financial statements, then the group needs to qualify for the reporting exemption under section 359(2) before it is exempted from including a business review in the directors' report.

| Q8. | Question A1h - Consequences of missing the “six months before the year-end” deadline for the business review For a private company falling within section 388(3)(c) of the CO, section 388(4) requires the members to pass a special resolution at least 6 months before the end of the financial year in order to exempt the directors from preparing a business review. What should the directors and members do if the directors miss this deadline but the members still wish to support the directors’ intentions not to prepare the business review? |

If the directors miss the “six months before the year-end” deadline, then they must comply with the full requirements for that financial year (i.e. they must prepare a business review) or seek legal advice on the consequences of failing to comply with the relevant statutory requirements, unless they are able to claim exemption under either section 388(3)(a) or 388(3)(b). Failure to meet the six months deadline cannot be excused by the members as this is a statutory requirement.

Note: As per section 388(3)(a) and (b), private companies can also be exempt from preparing a business review if they meet the size and approval tests for the reporting exemption set out in section 359 or they are a wholly owned subsidiary of another body corporate as defined in section 357(3). These alternative routes should be checked if the directors have failed to take steps to pass the special resolution in time and still wish to be exempt from preparing a business review. Also, it should be noted that failing to meet this deadline in one financial year does not preclude the directors from taking steps to meet them in good time for the next financial year. Also it should be noted that the special resolution that may be passed by private companies in accordance with section 388(3)(c) and (4) in order to claim exemption from preparation of a business review can be worded such that it grants exemption for more than one financial year or until revoked. See also Question A5 “Delivery of special resolution to the Companies Registrar”.

| Q9. | Question A2 – Disclosure of directors' names What are the requirements for disclosure of directors' names under the new CO? [UPDATED] |

Section 390(1)(a) states that the directors' report must contain the name of every person who was a director of the company either during the financial year or during the period beginning with the end of the financial year and ending on the date of the directors' report.

However, if the company is required to prepare a consolidated directors' report (as per section 388(2)), then section 390(3) states that, subject to section 390(4), section 390 has effect as if a reference to "the company" in section 390(1) or (2) were a reference to "the company and the subsidiary undertakings" included in the annual consolidated financial statements for the financial year. This means that the names of any persons who were or are directors of any company in the group included in the consolidated financial statements need to be disclosed in the holding company's consolidated directors' report in such cases.

Effective from 1 February 2019, section 390(4) to (7) provides an alternative way for a holding company to disclose such information either by listing the names of the directors of all subsidiary undertakings on its website, or by keeping such a list at its registered office and making it available for inspection. This amendment to the CO is consistent with guidance on practical measures contained in an earlier FAQ issued by the Companies Registry.

Holding companies will still need to collect and collate the information for all subsidiary undertakings included in the consolidated financial statements to compile the list of directors' names and to ensure that they have appropriate mechanisms in place to update the list for appointments, resignations and removals of directors.

| Q10. | Question A3 – Disclosure of principal activities What information has to be disclosed about principal activities under the new CO? How does this link to the business review? |

Section 390(1)(b) states that the directors' report must contain the principal activities of the company in the course of the financial year.

Section 390 is applicable to all companies required to prepare a directors' report i.e. there is no exemption from its requirements. Therefore, a statement of principal activities is required to be made by all companies as a minimum. Those companies that are also required to prepare a business review under section 388, will then provide further discussion and analysis in their directors' reports relating to those principal activities in accordance with Schedule 5.

For groups, the statement of principal activities will be prepared on a consolidated basis and any required business review will provide further discussion and analysis in the consolidated directors' report relating to the consolidated principal activities in accordance with Schedule 5. This is because section 390(3) states that section 390 has effect as if a reference to "the company" in subsection (1) or (2) were a reference to "the company and the subsidiary undertakings" included in the annual consolidated financial statements for the financial year.

| Q11. | Question A4 – Contents of the directors' report Section 129D(3) of the predecessor CO (Cap. 32) contained the disclosure requirements for the directors' report |

Answer

The disclosure requirements for the directors' report under the new CO are contained in the following locations:

- Sections 388, 390 and 543(2)

- Schedule 5 "Contents of Directors' Report: Business Review" (unless exempt under section 388(3)); and

- Companies (Directors' Report) Regulation (Cap. 622D)

In addition, section 391 sets out the requirements relating to the approval and signature of the directors' report.

| Q12. | Question A5 – Delivery of special resolution to the Companies Registrar If a company opts not to prepare a business review by way of passing a special resolution, is the company required to deliver the special resolution to the Companies Registrar for registration? |

Answer

Section 622 on registration of and requirements relating to certain resolutions applies to a special resolution, other than a special resolution to change the name of a company passed under section 107 or 770.

Section 622(2) requires the company to deliver a copy of the resolution to the Companies Registrar for registration within 15 days after it is made or passed. If the resolution is not in writing, a reference to a copy of the resolution is to be construed as a written memorandum setting out the terms of the resolution. A company is required to keep records comprising copies of resolutions and minutes of general meetings in the manner prescribed in section 618.

In case a company contravenes Section 622(2), the company and every responsible person of the company commit an offence, and each is liable to a fine at level 3 and, in the case of a continuing offence, to a further fine of HK$300 for each day during which the offence continues.

| Q13. | Question A6 – Reference to Regulation Both section 388(1) and section 388(2) state that the directors must prepare a directors' report which contains the information prescribed by the Regulation and complies with other requirements prescribed by the Regulation. In relation to the above which Regulation does section 388 refer to? |

Answer

The Regulation that section 388(1) and (2) refers to is the Companies (Directors' Report) Regulation (Cap.622D). Such Regulation provides for the information that is required to be contained in a director's report under section 388(1) and (2) of the Ordinance and other requirements prescribed for the report.

| Q14. | Question A7 – Disclosure of items under Companies (Directors' Report) Regulation Under section 388(2) if the company is a holding company in a financial year and the directors prepare annual consolidated financial statements for the financial year, the directors must instead prepare a consolidated directors' report for the financial year. Would the abovementioned reference to consolidated directors' report in section 388(2) have any impact on the disclosure requirements of the Companies (Directors' Report) Regulation (Cap.622D) (C(DR)R) such that the disclosure items in that Regulation need to be reported on a consolidated basis? |

Answer

No. The reference to consolidated directors' report in section 388(2) does not automatically cause the reporting items in the C(DR)R to be reported on a consolidated basis. For example, the requirement in section 8 of the Regulation which requires the reasons for a director’s resignation to be disclosed only applies if a director of the company has resigned. Even if the directors’ report is a consolidated report being prepared under section 388(2), there is no need to disclose information in relation to the resignation of a director of any of the company’s subsidiary undertakings in that report. Instead, that information will be disclosed in the directors’ report of the relevant subsidiary undertaking, if it is incorporated in Hong Kong.

| Q15. | Question A8 – Location of the business review Schedule 5 states that a directors’ report for the year must “contain” a business review. Can this requirement be met by including a cross reference in the directors’ report to where this review is located if it is included elsewhere in the annual report? For example, there are many similarities between the requirements already in the Listing Rules for listed issuers to include a Management Discussion and Analysis (MD&A) in the annual report and the prescribed contents of a business review set out in Schedule 5. This MD&A has typically not been included inside the directors’ report section of the annual report. Is it acceptable for directors of listed issuers to meet the requirements of Schedule 5 by including a cross reference in the directors’ report to where the MD&A may be found? |

Answer

Yes, provided that

(a) the cross reference is clear and it is clearly stated that the cross referenced part of the annual report forms part of the directors’ report; and

(b) the discussion and analysis found in that MD&A is sufficient to meet the minimum content requirements of Schedule 5.

In order for the cross reference to be clear, it should be a reference to a specific part of the annual report which includes a discussion of the business as prescribed by Schedule 5. It should not simply be a cross reference to the financial statements, since it is clear that the intent of the requirement in section 388 and Schedule 5 is for the directors to provide additional commentary in their report to the shareholders.

The following wording is an example of such a cross reference from the directors’ report to elsewhere in the annual report. This example combines the disclosure required by section 390(1)(b) in relation to the principal activities of the company (or group) with the requirement in section 388 to prepare a business review which complies with Schedule 5. It assumes that the company preparing the financial statements is required to prepare consolidated financial statements:

"Principal Activities and Business Review

The principal activities of the group are … [describe the principal activities of the company and all the subsidiary undertakings included in the consolidated financial statements i.e. the principal activities of the group]. Further discussion and analysis of these activities as required by Schedule 5 to the Companies Ordinance, including a discussion of the principal risks and uncertainties facing the group and an indication of likely future developments in the group’s business, can be found in the Management Discussion and Analysis set out on pages xx to yy of this Annual Report. This discussion forms part of this Directors’ Report."

| Q16. | Question B1 – Capital contributions How should a company account for a shareholder's contribution (e.g. waiver of loan) in equity in its financial statements under the new CO? Should it be credited to share capital or to a reserve? |

Answer

It depends. The company and the shareholder should agree whether the shareholder's contribution is intended to be an increase in share capital or it is in the nature of a gift. The company will credit a shareholder's contribution to share capital in the former case but it will credit it to an "other reserve" outside share capital in the latter. As explained below, different legal constraints on the subsequent use of the contribution will apply depending on its classification as share capital or "other reserve".

If the company credits the shareholders' contribution directly to share capital, it will do so under section 170(2)(b). This section states that a company may increase its share capital without allotting and issuing new shares, if the funds or other assets for the increase are provided by members of the company. Alternatively, the company may treat this as an indirect increase in share capital through a capitalization of profits under section 170(2)(c). This section permits a company to capitalize its profits, with or without allotting and issuing new shares. When a company credits a shareholder's contribution either directly or indirectly into share capital, it alters its share capital. Therefore, the company is required by section 171 to deliver a notice of alteration of share capital to the Registrar.

Where the shareholder's contribution is in the nature of a gift and not a subscription for new shares, a company will credit the amount to an "other reserve" outside of share capital. There is no requirement to notify the Registrar about an alteration of a reserve outside of share capital.

If the contribution is credited to share capital, then the requirements of Part 5 will apply if the company subsequently wishes to reduce share capital. For example, a solvency test and period of publicity may be required before capital may be repaid. On the other hand, if the contribution is credited to a reserve outside of share capital then the requirements of Part 6 will apply if the company subsequently wishes to make a distribution of that reserve (see question B2 below). This difference may be an important factor to consider when the company and shareholder agree the nature of the contribution and decide whether to record the contribution as an increase in share capital or as a reserve outside share capital.

| Q17. | Question B2 – Distributable profits Is the guidance in the Institute Accounting Bulletin 4 "Guidance on the determination of realised profits and losses in the context of distributions under the Hong Kong Companies Ordinance" still applicable under the new CO? |

Answer

Yes. The provisions of sections 79A to 79P of the predecessor CO have been brought forward largely unaltered to form Part 6 (i.e. sections 290 to 306). Therefore, the guidance in Accounting Bulletin 4 on how to determine realized profits and losses is still applicable under the new CO.

| Q18. | Question C1 – Company level statement of financial position in consolidated financial statements The predecessor CO requires a holding company's statement of financial position to give a true and fair view despite the fact that the company prepares consolidated financial statements instead and that the consolidated financial statements would give a true and fair view (sections 123 and 125 of the predecessor CO). To comply with such a requirement under the predecessor CO, holding companies normally include the company's statement of financial position as one of the primary statements in its consolidated financial statements (with the related notes included in the notes to the consolidated financial statements).The auditors express an opinion on both the consolidated financial statements as well as on the holding company's statement of financial position. Is there any change in the new CO with regard to the above requirement? |

Answer

Yes. The new CO does not require a true and fair view to be given on a holding company's statement of financial position when the holding company prepares consolidated financial statements. (ref: section 379(2) and section 380(2)).

Instead, section 2 of Schedule 4 requires that the consolidated financial statements of a holding company should contain the company's statement of financial position in the notes to the annual consolidated financial statements and also a note disclosing the movement in the holding company's reserves. Section 2(2) of Schedule 4 also explicitly states that there is no need to include any notes to the holding company's statement of financial position. Even though the holding company's statement of financial position is included in the notes to the consolidated financial statements section 2(3) of Schedule 4 requires that it must be in a format that complies with HKAS 1 "Presentation of Financial Statements".

The auditors' report will cover the consolidated financial statements as a whole, including the notes containing the holding company's statement of financial position and the movement in its reserves, in accordance with section 406(1)(b)(ii).

Note: This requirement to include the holding company's statement of financial position in the notes to the consolidated financial statements applies to all companies that are required to prepare consolidated financial statements. There is no exemption for companies eligible for the reporting exemption. However, the format and contents of that holding company's statement of financial position would follow the SME-FRF and SME-FRS when the consolidated financial statements are prepared in accordance with that standard (in accordance with section 2(3) of Part 4).

| Q19. | Question C2 – Disclosure of directors' emoluments and other matters that involve directors in the notes to the financial statements Does the new CO require any disclosures regarding directors' emoluments and other matters that involve directors in the notes to the financial statements? [UPDATED] |

Answer

Section 383 requires the information prescribed by the relevant Regulation about the following items to be disclosed in the notes to the financial statements:

(a) the directors' emoluments;

(b) the directors' retirement benefits;

(c) payments made or benefit provided in respect of the termination of the service of directors, whether in the capacity of directors or in other capacity while directors;

(d) loans, quasi-loans and other dealings in favour of (i) directors of the company and a holding company of the company; (ii) bodies corporate controlled by such directors; (iii) entities connected with such directors;

(e) material interests of directors in transactions, arrangements or contracts entered into by the company;

(f) consideration provided to or receivable by third parties for making available the services of a person as a director or in any other capacity while director.

The relevant Regulation for the purposes of section 383 is the Companies (Disclosure of Information about Benefits of Directors) Regulation Cap. 622G ("the Directors’ Benefits Regulation") . This Regulation sets out detailed disclosure requirements and interpretative guidance for the above matters and must be followed by all companies preparing financial statements unless there is a specific exemption (for example, section 23 grants an exemption from Part 4 of the Directors’ Benefits Regulation to companies eligible for the reporting exemption – this effectively grants an exemption from disclosing information relating to item (e) above).

In addition, section 1 of Schedule 4 to the new CO requires that the financial statements for a financial year must contain, under separate headings, the aggregate amount of any outstanding loans made under the authority of sections 280 and 281 during the financial year. While directors are explicitly excluded from the scope of section 281, loans made to them for the purposes of employee share schemes may fall under the scope of section 280.

In the case of a holding company that has to prepare consolidated financial statements and a consolidated directors' report, there is no requirement to make the disclosures required by section 383 and the Directors’ Benefits Regulation on a consolidated basis. These disclosures are limited to the directors of the holding company only.

| Q20. | Question C3 – The adoption of financial reporting standards for the purpose of the new Companies Ordinance Companies incorporated in Hong Kong are required by Part 9 to prepare annual financial statements which comply with the general requirements of section 380. For such purpose, can a company prepare its financial statements using IFRS Accounting Standards or other standards issued by a standard-setting body other than the Institute? [UPDATED] |

Answer

Section 380(4)(b) states that the financial statements for a financial year must comply with "the accounting standards applicable to the financial statements". Under section 357(1) accounting standards means statements of standard accounting practice issued or specified by a body prescribed by the Regulation. Only the Institute is prescribed for the purposes of section 357(1) under the current Companies (Accounting Standards (Prescribed Body)) Regulation (Cap.622C).

For the purposes of section 380(4)(b), there are 3 sets of accounting standards (otherwise known as frameworks) issued by the Institute:

1 HKFRS Accounting Standards

2 The HKFRS for Private Entities Accounting Standard (HKFRS for PE); and

3 The Small and Medium-sized Entity Financial Reporting Framework and Financial Reporting Standard (SME-FRF & SME-FRS).

All Hong Kong incorporated companies may choose to prepare their financial statements in accordance with HKFRS Accounting Standards. However, only eligible companies may choose to adopt the HKFRS for PE or the SME-FRF & SME-FRS, as explained below.

For a company incorporated in Hong Kong which falls within the section 359 reporting exemption

Such company is permitted to prepare their financial statements under any one of the above 3 frameworks, however, it must choose one of these frameworks issued by the Institute for the purposes of complying with section 380(4)(b). Each of these frameworks includes specific provisions which apply in the first period in which an entity chooses to adopt that framework. Moving from one framework to another is therefore not expected to be common.

For a company incorporated in Hong Kong which is not eligible for the reporting exemption

Such company will be in breach of section 380(4)(b) unless its statutory financial statements contain an explicit and unreserved statement of compliance with HKFRS Accounting Standards, or HKFRS for PE (if eligible for that standard), as issued by the Institute. Section 380(3) and Schedule 4 Part 1 Section 4(a) require that the financial statements must state whether they have been prepared in accordance with the applicable accounting standards as defined by section 357(1). However, this does not prohibit a dual compliance statement stating that the financial statements comply with both HKFRS Accounting Standards and with a basis or standard of accounting other than HKFRS Accounting Standards provided that the financial statements satisfy the requirements of both accounting frameworks.

For example, if an existing IFRS reporter wishes to assert dual compliance with HKFRS Accounting Standards and IFRS Accounting Standards, it would be necessary that no material changes to accounting policies or reported amounts were made as a result of applying the requirements of HKFRS 1 First-time adoption of Hong Kong Financial Reporting Standards on transition to HKFRS Accounting Standards.

Similarly, if a company had not previously included an explicit and unreserved statement of compliance with IFRS Accounting Standards as issued by the IASB in its financial statements and wishes to do so in addition to continuing to comply with HKFRS Accounting Standards, it would be necessary that no material changes to accounting policies or reported amounts were made as a result of applying the requirements of IFRS 1 First-time adoption of International Financial Reporting Standards.

| Q21. | Question C4 – Information required to be disclosed by section 383(1)(e) of the CO on material interests of directors Part 4 of the Companies (Disclosure of Information about Benefits of Directors) Regulation (C(DIBD)R or Cap. 622G) deals with disclosure in the notes to the financial statements of material interests in transactions, arrangements or contracts entered into by the company in accordance with section 383(1)(e) of the CO. What information needs to be disclosed, and where, about “material interests of directors in transactions, arrangements or contracts entered into by … another company in the same group of companies” that was previously required by section 129D(3)(j) of the predecessor ordinance (Cap. 32) and was also mentioned in section 388(1)(e) until the 2018 Amendment Ordinance amended that section? [UPDATED] |

Answer

Requirements relating to disclosure of material interests of directors in transactions, arrangements or contracts entered into by other group companies can be found in section 10 of the Companies (Directors’ Report) Regulation (C(DR)R or Cap. 622D). This section of the C(DR)R brings forward the remainder of the scope of section 129D(3)(j) of the predecessor Ordinance (Cap. 32) by requiring disclosure in relation to such transactions entered into by a “specified undertaking” of the company and in which a director of the company had a material interest. “Specified undertaking” is defined in section 2 of the C(DR)R as a parent company of the company, a subsidiary undertaking of the company or a subsidiary undertaking of the company’s parent company (i.e. a fellow subsidiary undertaking).

In other words, this requirement in section 10 of the C(DR)R covers “material interests of directors in transactions, arrangements or contracts entered into by … another company in the same group of companies”, with the effect that information relating to other group companies is therefore required to be disclosed in the directors’ report and not in the notes to the financial statements.

| Q22. | Question D1 – Exemption from giving a true and fair view If a company is eligible for the reporting exemption but decides not to follow the SME-FRF and SME-FRS is it still exempt from preparing financial statements which give a true and fair view? |

Answer

No. Every company that is required to prepare financial statements under the new CO is required by section 380(4)(b) to comply with the accounting standards applicable to the financial statements. "Accounting standards" are defined in section 357(1) as being those issued or specified by the Institute (as per the Companies (Accounting Standards (Prescribed Body)) Regulation (Cap. 622C) referred to in section 357(1)).

Therefore, if an eligible company does not follow the SME-FRF and SME-FRS, then it must prepare financial statements which comply with another body of accounting standards issued or specified by the Institute, for example HKFRS Accounting Standards, which is a body of accounting standards intended to give a true and fair view if properly complied with.

| Q23. | Question D2 – Eligibility: Change in ownership after general meeting Under section 360, a larger private company not involved in any of the financial services lines of business listed in section 359(4) may use the SME-FRF & SME-FRS, if at least 75% of all the members pass a resolution at a general meeting that the company is to fall within the reporting exemption for the financial year, with none objecting. The 75% vote is calculated as a percentage of the entire shareholding of a company, not simply as a percentage of the shareholders who attend the general meeting. The resolution is defeated if any member objects either at the meeting or at any time by giving notice in writing to the company. This is provided that the written notice is given at least 6 months before the end of the financial year to which the objection relates. In the case where there is a change in ownership of the company after such resolution was passed at a general meeting, does the new CO or the SME-FRF & SME-FRS require that company to pass a new resolution at a general meeting for it to use the SME-FRF & SME-FRS? [UPDATED] |

Answer

The new CO or SME-FRF & SME-FRS contains no specific requirement mandating that a larger "eligible" private company (a company that complies with sections 359(1)(c) and 360(1)) must pass a new resolution at a general meeting to re-confirm its eligibility to use the SME-FRF & SME-FRS following a change in ownership. Therefore, if the new shareholders are in agreement with the earlier decision to use the SME-FRF & SME-FRS, then no further action is required.

If the new shareholders disagree with the earlier decision and it is at least 6 months before the end of the financial year, then they may exercise their right to object under section 360(3), causing the company to be ineligible for the reporting exemption. In all other cases of disagreement, the new shareholders may consider seeking legal advice as to their ability to call for another vote and/or their rights (if controlling shareholders) to reverse the earlier decision.

| Q24. | Question D3 - Eligibility: Shareholders' approval in subsequent years Is it permissible under the new CO for a larger "eligible" company to pass a resolution to adopt the SME-FRF & SME-FRS for more than one year? [UPDATED] |

Answer

The new CO is silent on this matter. It is therefore a legal question as to whether the words of section 360(1) may be interpreted as allowing the company to pass a resolution in respect of more than one financial year.

However, as explained in response to Question D2, a larger "eligible" company (or group) will not have certainty about their ability to adopt the SME-FRF & SME-FRS until the later of a successful shareholder vote and a date 6 months before the end of the financial year in question. Therefore, even if a larger "eligible" company attempts to pass a resolution to adopt SME-FRF & SME-FRS for more than one year, it needs to be aware that the objection period will remain open for future years.

| Q25. | Question D4 – Eligibility: Hong Kong incorporated subsidiary of an overseas incorporated company Would a Hong Kong incorporated company being a subsidiary of an overseas incorporated company be disqualified from falling within the reporting exemption (thus the use of SME-FRF & SME-FRS) under section 359(1)(b)? [UPDATED] |

Answer

The intention of section 359(1)(b) is to bring forward the qualifying criteria that were previously found in section 141D of the predecessor CO. Under section 359(1)(b) a company falls within the reporting exemption for a financial year if:

(a) it is not:

- one that carries on any banking business and holds a valid banking licence granted under the Banking Ordinance (Cap.155); or

- one that is a corporation licensed under Part V of the Securities and Futures Ordinance (Cap.571) to carry on a business in any regulated activity within the meaning of that Ordinance; or

- one that carries on any insurance business otherwise than solely as an agent; or

- accepts, by way of trade or business (other than banking business), loans of money at interest or repayable at a premium, other than on terms involving the issue of debentures or other securities; and

(b) it does not have any subsidiary and is not a subsidiary of another company; and

(c) all members of the company agree in writing that the company is to fall within the reporting exemption for the financial year only.

Section 2 defines "company" as (a) a company formed and registered under the new CO or an existing company. "Existing company" is defined as a company formed and registered under a former Companies Ordinance. An overseas incorporated company is therefore not a company defined under the new CO.

Based on the above, being a subsidiary of an overseas incorporated company in itself will not disqualify a company incorporated under the Companies Ordinance from falling within reporting exemption under section 359(1)(b).

| Q26. | Question D5 - Delivery of shareholders' resolution or agreement on reporting exemption to the Companies Registrar There are certain types of companies that require a shareholders' resolution or agreement for them to fall within reporting exemption for the financial year. What are the thresholds of the required shareholders' resolution or agreement? Are the companies required to deliver the resolution or agreement to the Companies Registrar for registration? [UPDATED] |

Answer

The following types of companies are required to obtain shareholders' resolution or agreement in order for these companies to be eligible for the reporting exemption when preparing their directors’ report and financial statements:

|

Type of company |

Shareholder approval requirements |

|

1. The company is an "eligible" private company which fails the small size tests butfalls within the larger size tests (HK$200 million total annual revenue, HK$200 million total assets and 100 employees), and has no subsidiaries (section 359(1)(c), section 362 and Sch 3(1)(3)). |

A resolution has to be passed by at least 75% of all shareholders of the company (or the holding company in case of a group) (i.e. not merely 75% of the shareholders attending the meeting) in order for the company to be eligible for the reporting exemption.

This requirement to obtain approval from the reporting entity’s own shareholders applies regardless of whether or not that entity is a holding company i.e. it applies equally to Type 1 companies and Type 2 companies in this table. As from 1 February 2019, there is no requirement for a holding company to seek approval from the shareholders of any of its subsidiaries.

The resolution will fail if any shareholder votes against the resolution at a general meeting or if any shareholder objects in writing and gives notice of objection to the company at least six months before the end of the financial year to which the objection relates (section 360(1), section 360(2) and section 360(3)).

Alternatively, the company may pass a written resolution under section 548(1), which can be passed without a meeting and without any previous notice being required, for falling within the reporting exemption. A written resolution is passed when all eligible members have signified their agreement to it. However, for passing a written resolution the company needs to follow other procedures in subdivision 2 of division 1 in Part 12 of the new CO, which include notifying its auditor of the proposed resolution under section 555.

Please refer to subdivision 2 of division 1 in Part 12 of the new CO about written resolution. |

|

2. The company is a private company* which is the holding company of a group which fails the small size tests but falls within the larger size tests of HK$200 million total annual revenue, HK$200 million total assets and 100 employees when measured on a consolidated basis (section 359(2)(c)(ii), section 365, Sch 3(1)(11) and Sch 3(2)(2)).

NB As from 1 February 2019, a holding company falling within these size limits is eligible for the reporting exemption even if its group includes companies limited by guarantee (i.e. it is a “mixed group”), provided that it itself is a private company (section 359(3A) and section 366A(4))

* If the holding company is a company limited by guarantee, rather than a private company, then it is only eligible for the reporting exemption if its group as a whole falls within the annual revenue limit of HK$25 million applicable to companies limited by guarantee (section 359(3), section 366 and Sch 3(1)(13)). As from 1 February 2019, this is the limit which applies, even if that group is a mixed group i.e. even if the group contains some private companies (section 359(3A) and section 366A(4)(c)).

No shareholder approval is required if the group headed by a company limited by guarantee falls within this very small annual revenue limit. However, if the group as a whole exceeds this limit then the company is not eligible for the reporting exemption at all. In other words, shareholder approval cannot make a company limited by guarantee eligible for the reporting exemption if the consolidated annual revenue of the group of which it is the holding company exceeds HK$25 million.

|

|

|

3. The company is a private company which does not have any subsidiaries and is not a subsidiary of another Hong Kong incorporated company and has unanimous shareholder support (section 359(1)(b)). |

All the members of the company have to agree in writing that the company is to fall within the reporting exemption for the financial year (section 359(1)(b)(iii)).

|

Delivery of resolution or agreement to the Companies Registrar

Section 622 on registration of and requirements relating to certain resolutions applies to the resolution (whether special or written) for Types 1 and 2 (under section 622(1)(f)) and the agreement for Type 3 (under section 622(1)(e)).

Section 622(2) requires the company to deliver a copy of the special or written resolution or agreement to the Registrar for registration within 15 days after it is made or passed. If the resolution is not in writing, a reference to a copy of the resolution is to be construed as a written memorandum setting out the terms of the resolution. A company is required to keep records comprising copies of resolutions and minutes of general meetings in the manner prescribed in section 618.

If a company contravenes section 622(2), the company and every responsible person of the company commits an offence, and each is liable to a fine at level 3 and, in the case of a continuing offence, to a further fine of HK$300 for each day during which the offence continues.

| Q27. | Question D6 – Interaction between the eligibility for the reporting exemption (s.359) and the exemption from preparing consolidated financial statements (s.379(3)) For a holding company, which fulfills the requirement in section 379(3) and is exempted from the new CO's requirement to prepare consolidated financial statements, when assessing its eligibility for the reporting exemption should it be considered on a standalone basis (i.e. at company level) under section 359(1); or does each company in the group (including the holding company), and the group as a whole, need to pass the eligibility tests under s.359(2) before that holding company itself can fall within the reporting exemption? [UPDATED] |

Answer

There is no clear link stated in the new CO between the requirements in section 379(3) (on the eligibility for not preparing consolidated financial statements) and section 359 (on the eligibility for the reporting exemption). However it would seem reasonable to assume that a correlation is intended.

Based on such assumption, if a holding company is required to prepare consolidated financial statements, then the group needs to qualify for the reporting exemption under section 359(2) before it is qualified for simplified reporting (i.e. qualified for preparing consolidated financial statements under the SME-FRF & SME-FRS); whereas if the holding company does not need to prepare consolidated financial statements, then it may qualify for simplified reporting as a stand-alone company under section 359(1) and thus, qualify for preparing company-level financial statements only under the SME-FRF & SME-FRS.

| Q28. | Question E1 – Meaning of "wholly owned" Section 379(3) exempts a holding company from preparing consolidated financial statements if it is a "wholly owned subsidiary of another body corporate". Similarly, section 388(3) exempts a company wholly owned by another body corporate from preparing a business review. What does "wholly owned by another body corporate" mean? |

Answer

The definition of "wholly owned subsidiary of another body corporate" can be found in section 357(3). This states that a body corporate is a "wholly owned subsidiary of another body corporate" if it only has the following as its members:

| (a) | that other body corporate (for the meaning of "body corporate" see Question E2 below); |

| (b) | a wholly owned subsidiary of that other body corporate; |

| (c) | a nominee of that other body corporate or such a wholly owned subsidiary. |

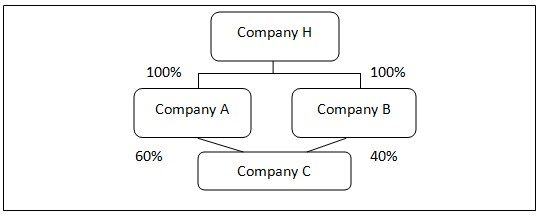

So, for example, in the following group Companies A, B and C are all "wholly owned subsidiaries of another body corporate", with that "other body corporate" being Company H

| Q29. | Question E2 - Meaning of "company" and "body corporate" Sometimes the new CO refers to a "company" and other times to a "body corporate". What is the difference? |

Answer

Section 2 sets out definitions for both of these terms. According to section 2(1):

- a "company" is a company formed and registered under the new CO, or an "existing company" (which is in turn defined as a company formed and registered under a former Companies Ordinance); whereas

- a "body corporate" includes a "company" and a company incorporated outside Hong Kong, but excludes a corporation sole.

In other words, a "company" for the purposes of the new CO is a Hong Kong incorporated company, whereas a "body corporate" must be an incorporated entity but need not be incorporated in Hong Kong. This means, for example, that the exemptions available in the new CO to companies which are "wholly owned subsidiaries of another body corporate" (such as in section 388(3) in respect of the business review) are available to Hong Kong incorporated subsidiaries of overseas incorporated parents, as well as to Hong Kong subsidiaries of Hong Kong incorporated parents.

| Q30. | Question E3 – Meaning of "financial year" The new CO refers to "financial year". Does this always mean 12 months or can a company prepare financial statements for a longer or shorter period? |

Answer

A "financial year" is usually 12 months but need not necessarily be 12 months, if the company is newly incorporated or when the directors decide to alter the "accounting reference date".

The requirements relating to the meaning of "financial year" can be found in Division 3 of Part 9 (sections 367 to 371). In accordance with these sections, a company's first "financial year" after the coming into operation of section 367 on 3 March 2014 starts on the first day of its first "accounting reference period" and ends on the last day of that "accounting reference period".

So the length of a "financial year" depends on the length of the company's "accounting reference period". This period is generally 12 months, in accordance with sections 368(3) and 370, except in the case of the first accounting reference period of a company incorporated under the new CO (i.e. the period from the date of the company's incorporation to its "primary accounting reference date" (sections 369(5) to (7) and 370)) or when the directors decide to alter the accounting reference date (i.e. the end of the reporting period) in accordance with section 371. That section permits directors to shorten or lengthen the accounting reference period by altering the accounting reference date. This is subject to certain restrictions as set out in that section.

However, in no circumstances is a company's accounting reference period (and thus a financial year) permitted to be longer than 18 months (see sections 369(6) and 371(5)).

| Q31. | Question E4 – When will section 436 first affect interim financial reports? Section 436(3) deals with certain statements that need to be made in respect of non-statutory accounts. Interim financial reports prepared in accordance with HKAS 34 fall within the scope of section 436 as a form of non-statutory accounts, as it is a requirement of HKAS 34 that the interim financial report contains the statement of financial position as of the end of the preceding financial year. Consequently, when is section 436 first effective so far as interim financial reports are concerned? For example, does it impact on the interim reports for years ending in 2015, such as half year reports ending on 30 June 2015 for a December 2015 financial year end? |

Answer

Section 358(3) states that section 436 is first effective in relation to financial statements for a financial year beginning on or after the commencement date of that section. In other words section 436 is first effective in relation to financial statements for financial years beginning on or after 3 March 2014.

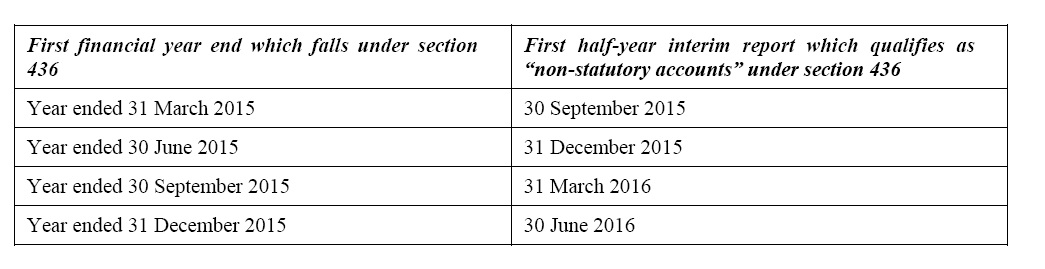

However, for December year ends the first half-year interim financial reports expected to be affected will be the June 2016 interims. This is because for December year ends, the first financial year of the company which falls under section 436 is the year ended 31 December 2015. It is too early for the June 2015 interim financial report to include financial information for that full year and the comparative statement of financial position for the preceding financial year is for the year ended 31 December 2014, which commenced before 3 March 2014. Instead, the first interim report impacted by section 436 will be the June 2016 interim financial report, which will contain the statement of financial position as at 31 December 2015 as comparative information.

In summary:

| Q32. | Question E5 – Can a “financial year” be set to end on a specific day of the week rather than a specific date? Some companies find it convenient to prepare their financial statements for a financial period ending on the same day of the week each year, rather than on the same date each year, for example setting the financial year to end on the last Friday in January each year. This means that each “financial year” (see Question E3 for the meaning of financial year) is generally 52 weeks long, with a 53 week year every seven years. Is this practice acceptable under the new CO? [UPDATED] |

Answer

Yes, this is now expressly provided for in the CO. Specifically, section 367 was amended by the 2018 Amendment Ordinance to permit the company to shorten or lengthen the financial year by a period not exceeding 7 days. This amendment is effective as from 1 February 2019.NB The requirement to obtain a directors’ resolution under section 371(3) when shortening or lengthening an accounting reference period (which requirement is found in section 368(3)) does not apply if a company takes advantage of the amended section 367 to shorten or lengthen its financial year by a few days. This is because taking advantage of the amended section 367 is not setting a new accounting reference date within the meaning of section 371.